We’re scaling housing attainability.

Options for Homes manages our portfolio of shared equity down payment loans, creating real impact for individuals and families. We also work with government and third-party partners to administer down payment assistance programs that make homeownership more attainable. With over 30 years in housing finance, we scale programs that create lasting positive change for communities.

How we administer housing programs

We handle operational complexity so governments and organizations can focus on policy development and program expansion.

Shared equity program management

Direct administration of shared equity programs for homebuyers, and managing repayment upon resale.

Third-party portfolio administration

Complete portfolio management services for municipal, provincial, federal, and non-profit organizations including compliance and reporting processes.

Government and community housing programs

Administration that supports public housing initiatives, ensuring alignment with policy objectives while maintaining operational efficiency and transparency.

Our impact

Helping Canadian families build wealth and stability through shared equity homeownership.

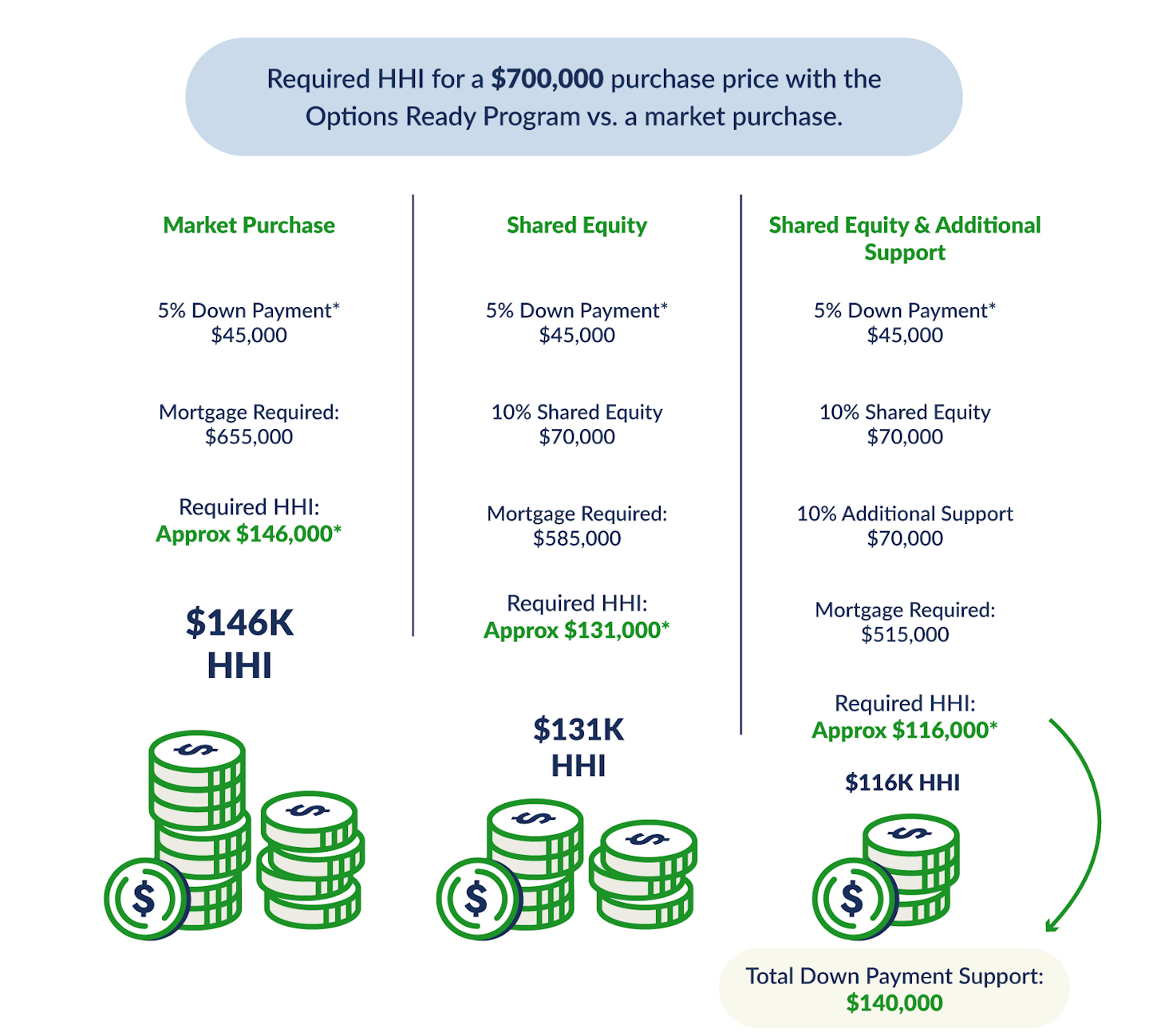

Deepening affordability

We deepen affordability by layering additional down payment support from multiple funding sources including local municipalities and federal programs — opening the door to homeownership for more families.

The Options Ready Program as down payment support helps make homeownership

more affordable in three key ways:

Having a larger down payment

helps lower household incomes

(HHI) required to purchaseA lower mortgage results in

reduced carrying costsIt improves affordability as it

requires no scheduled monthly

payments of principal or interest

*You must have 5% down payment of your own money for the first $500,000 and 10% on any amount above $500,000. Estimated HHI dependent on bank lending requirements.

Connect with us

Whether you're developing new attainability programs or need administration support for existing portfolios, we'd welcome the opportunity to discuss your needs.

The provision of mortgages is a regulated service under the Mortgage Brokerages, Lenders and Administrators Act, 2006 (“MBLAA”) and requires specific mortgage brokerage and mortgage administrator licensing. Through the Financial Services Regulatory Authority (“FSRA”), HOA holds licenses as a Mortgage Administrator and Mortgage Brokerage company.

Mortgage Broker Lic. #12009 Mortgage Admin. Lic. #12600