What if homeownership was actually within reach?

The Options Ready Program helps you gain the financial know-how and down payment support you need to help you make homeownership a reality.

Here's how it works:

Become a homeowner in just four steps:

Qualify for a mortgage from a tier 1 Canadian bank or credit union.

This helps us assess the homes that are within your reach, with some support.Save a 5% (or more) down payment.

You’ll need to contribute 5% of your own money (10% for amounts above $500,000).Purchase an Options for Homes property.

The down payment support we provide will then be arranged in the form of a shared equity second mortgage.Move in!

We’re here for people who need a place to call home—not investors. You must live in your home to qualify.

Your Homeownership Journey with the Options Ready Program

You have a good income, you qualify for a bank mortgage, and you’ve saved a 5% down payment. You’re ready to buy your Options home!

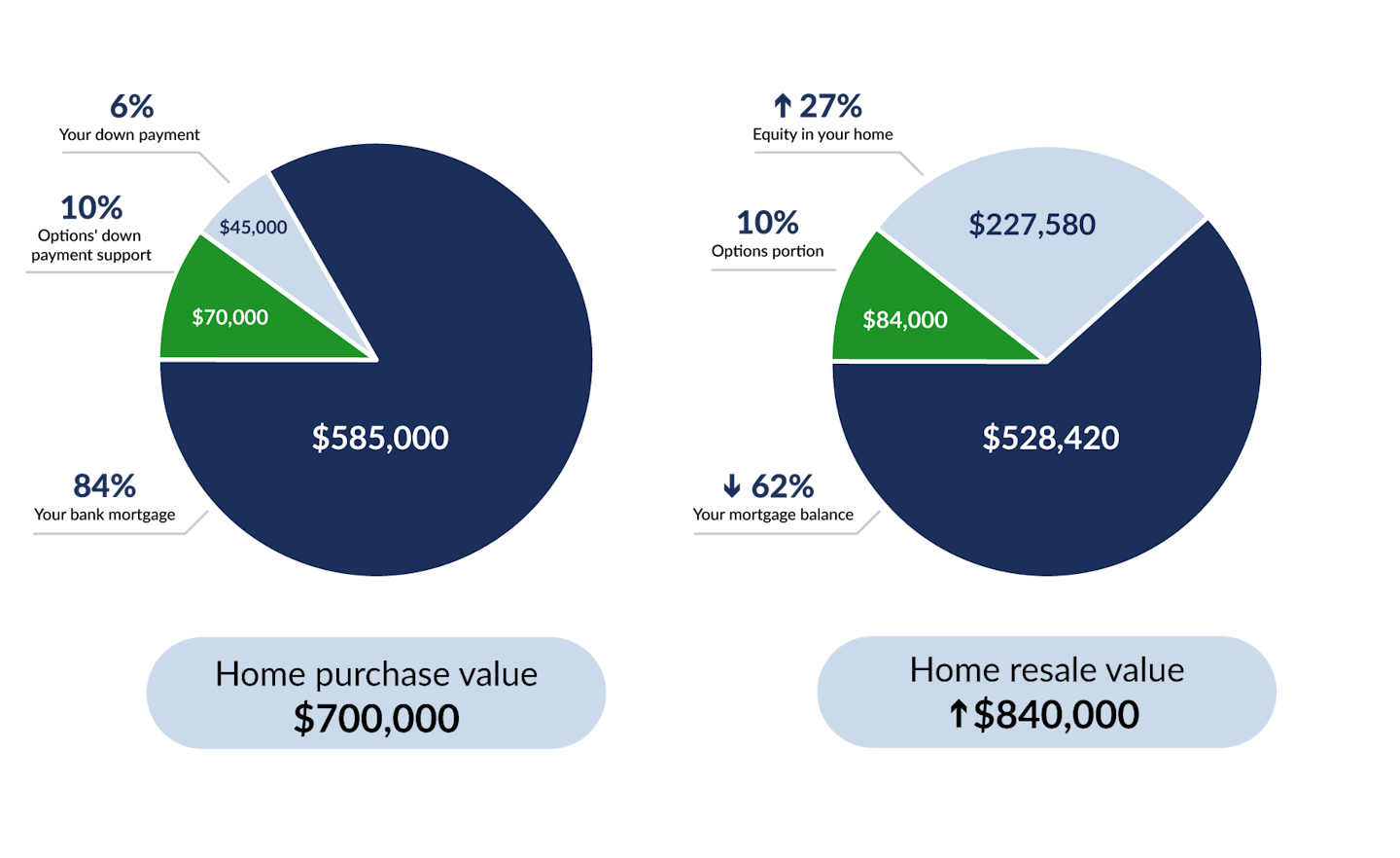

Buying your home

Home price: $700,000 Your down payment required*: $45,000 (6%) Options down payment support: $70,000 (10%) Your bank mortgage: $585,000 (84%) Selling your home

Resale value: $850,000 Your shared equity:

(what you keep)$227,580 (27%) Options shared equity:

(repaid to Options)$84,000 (10%) Your mortgage balance: $528,420 (62%)

This appreciation is an estimate and hypothetical. Market conditions will affect actual appreciation. This model is based on a unit sold after 5 years; a 5-year fixed-rate mortgage with 25-year amortization at 4.26% interest. Rates calculated as of May 2025.

*At times we have additional sources of funding available. Get in touch to learn more.

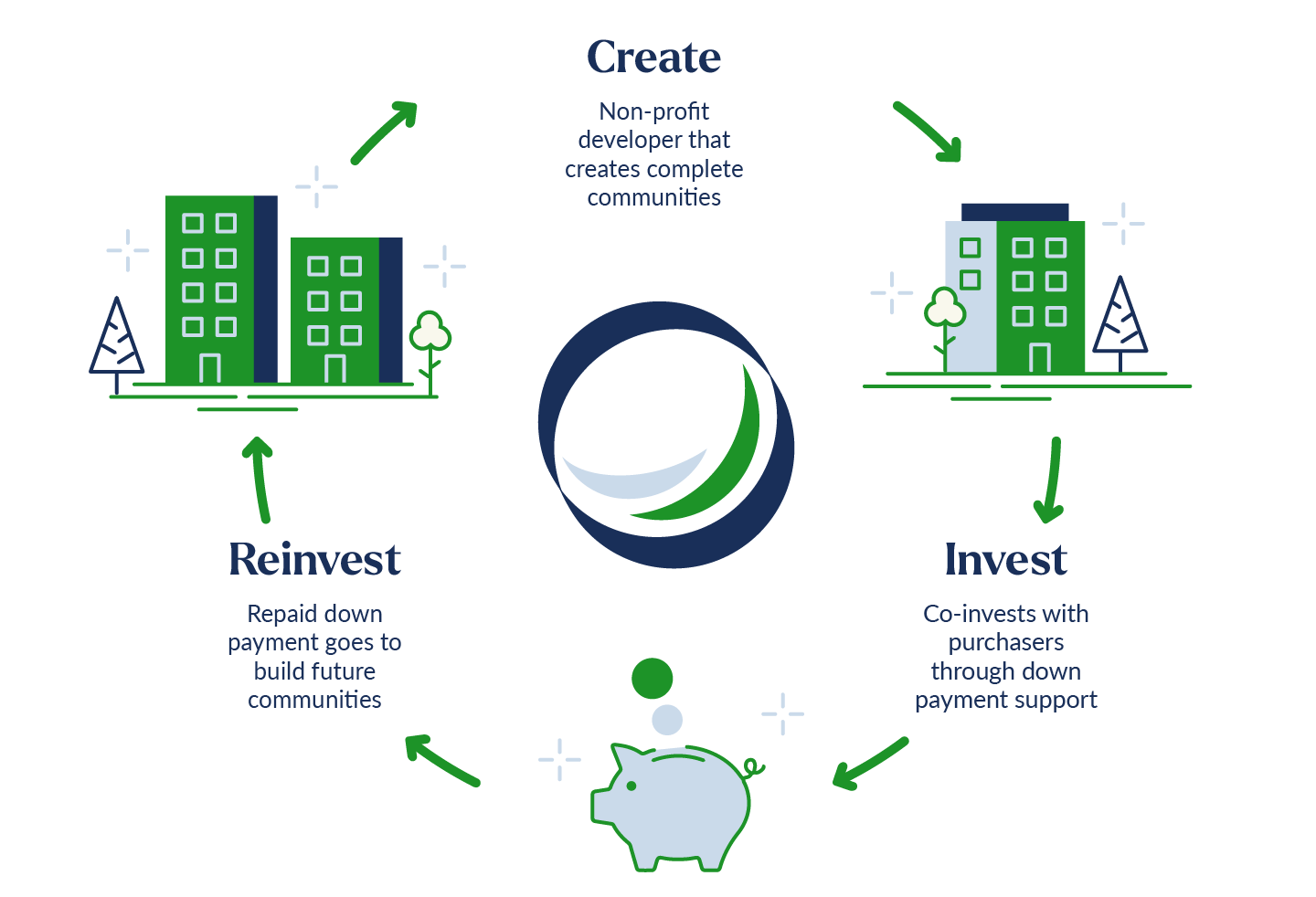

With Options for Homes, everyone benefits.

Our social purpose mission means we continuously reinvest in housing opportunities for more people. When you repay your down payment, those funds are used to create new buildings and enable more people to become homeowners.

Meet Kamiko

I'm the first person in my little immediate family to own a home. It's definitely something that I want to make sure that my kids have the opportunity to have as well.”

- Kamiko from Scarborough, ON

Want to learn more?

Check out our Resources section for helpful tools and articles to help you become an informed home buyer.

Stay up to date

Sign up for our newsletter for the latest news and updates about our developments.

*Required fields